Umbrella Payroll Company Software

We can handle various payroll models, including the most common below. Why not book a Demo today and find out how we can help your payroll company thrive.

The UK’s Most Powerful Payroll Engine

Experience the UK’s most powerful payroll processing engine built to handle bulk payroll with ease. Whether you're processing 100 payslips or 10,000, our unlimited engine delivers results in seconds, without breaking a sweat.

Process multiple pay models all at once

PAYE

Pay As You Earn (PAYE), a system used in the UK to collect income tax and National Insurance contributions directly from employees’ wages. The amount of income tax deducted depends on the employee’s income level and tax code. National Insurance contributions are also collected to fund state benefits, pensions, and healthcare. Additionally, PAYE may include other deductions such as student loan repayments and workplace pension contributions.

Umbrella

Umbrella payroll refers to a system used by contractors or freelancers who work through an umbrella company. The umbrella company acts as an intermediary between the contractor and the end client or recruitment agency. Instead of operating as a self-employed individual or through their own limited company, the contractor is employed by the umbrella company.

CIS

CIS stands for the Construction Industry Scheme. It is a set of tax rules in the UK that applies to businesses and individuals working in the construction industry. The CIS is designed to ensure that contractors in the construction sector pay the correct amount of tax and National Insurance, and it helps prevent tax evasion.

Self Employed & Ltd Co

This model is aimed at Self-employed contractors working outside the construction sector and not caught by the false self employment legislation.

PEO & Joint Employment

A PEO model is where a business engages with other businesses (End User) and offers an ‘intermediary solution’. It means that the End User can outsource vital HR tasks such as: Payroll management.

Check out some of our stand-out features

Just a few reasons why NXSYS is changing the Payroll software scene!

See more than just Payslips

Our streamlined dashboard makes payroll processing effortless whether for one worker or thousands. With NXSYS, you can easily validate payroll, generate automated client invoices, and process payments via bank files formatted for any UK bank

Smart payroll dashboard

With our streamlined payroll dashboard, we make processing payroll for 1 worker or 1000’s as easy as 1, 2, 3. NXSYS allows you to easily validate your payroll, send automated invoices to your Clients and process payroll via a bank file formatted for any UK Bank.

Real time Agency portal

The NXSYS Client/Agency Portal offers a dedicated, real-time view for your clients putting essential workforce and payroll data right at their fingertips.

- Track worker onboarding progress in real time

- View complete worker profiles, payroll details and expenses

- Access and download timesheets, invoices, and credit notes

- And much more, all in a secure and user-friendly interface

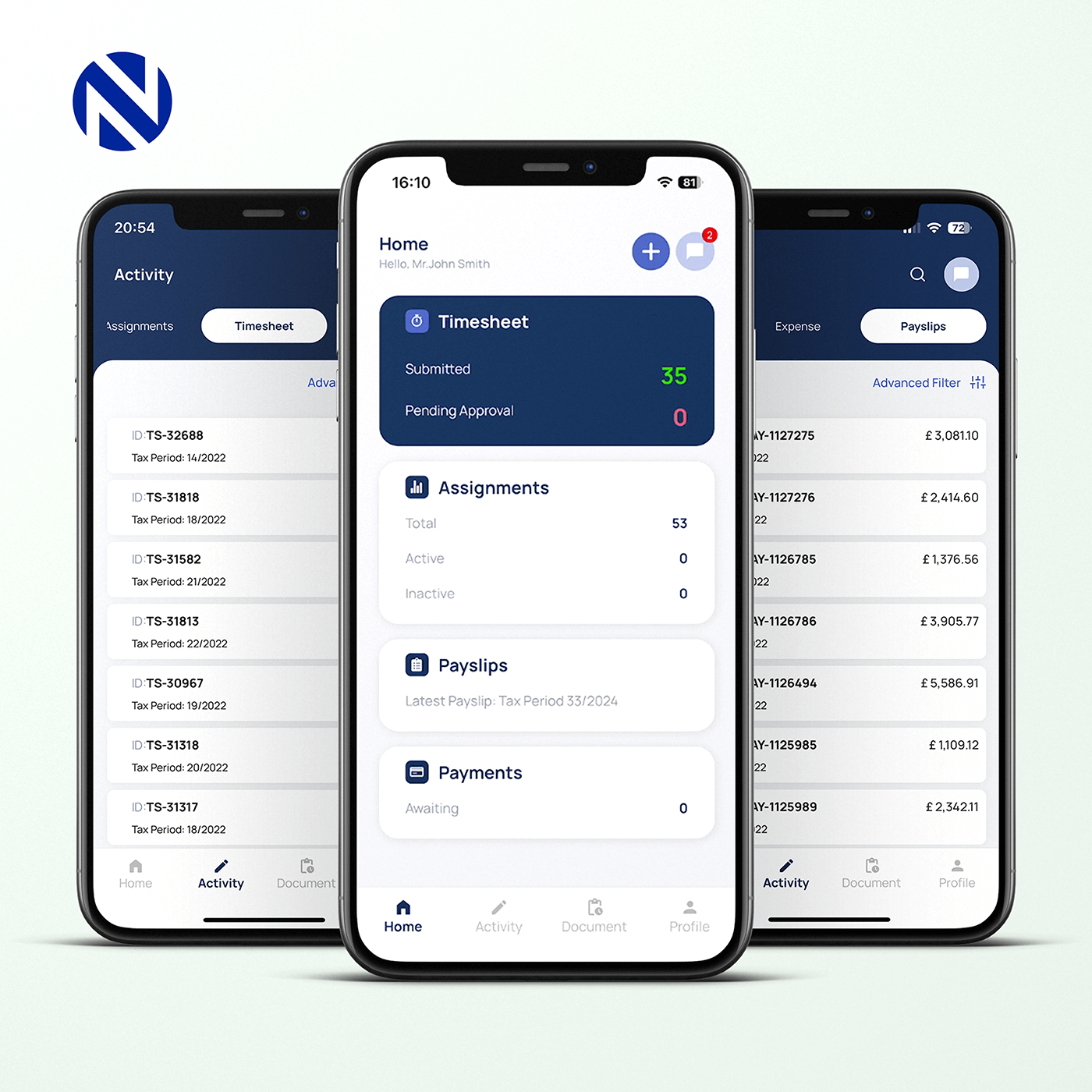

An extra perk for your workers

NXSYS offers an extra perk for your workers through a unique integration with Boostworks Benefits, delivering a seamless and rewarding experience. With just a tap in the NXSYS App, employees can access your fully branded benefits portal making it easier than ever to engage with incentives, perks, and wellbeing tools.

Smart Compliance features for your business

We focus on building compliance into every feature at Nxsys. Have a look at some of our compliance partners below and get in touch today.

HMRC Recognised and RTI Compliant

Do more than just submit RTI. NXSYS integrates with HMRC to ensure your worker data stays accurate and up to date. Check out HMRC’s newly launched Umbrella Pay Calculator below.

Real time auditing with Saferec

SafeRec’s AI-powered technology transforms payroll compliance by enabling real-time auditing of your supply chains and umbrella companies.

Professional Passport Supply Partner

Professional Passport provides cost-effective compliance and risk management solutions alongside impartial, reliable advice for the HR and payroll sectors.

Talk to us today

Lets discuss your project and find out how Nxsys can help